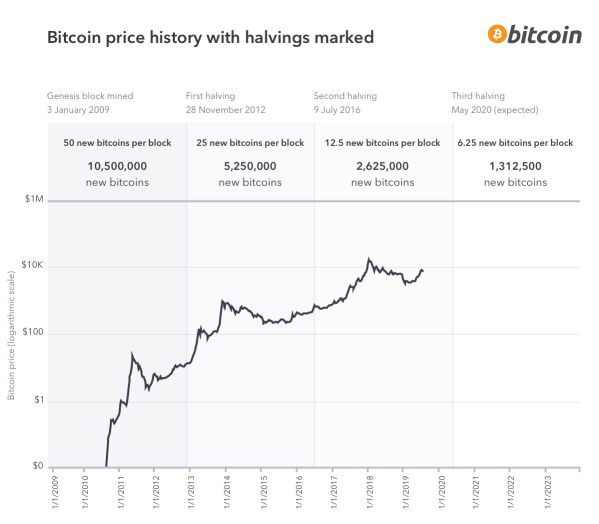

A bitcoin halving (sometimes ‘halvening’) is an event which reduces by 50% the amount of bitcoin rewarded to bitcoin miners who discover a new network block. These events are important for traders because of the potential impact these reductions can have on the number of new bitcoins being generated by the network. Bitcoin halvings are scheduled to occur once every 210,000 blocks until the maximum supply of 21 million bitcoins has been generated by the network.

The Bitcoin mining process requires all miners to successfully solve several mathematical and cryptographic problems using various computational resources before their blocks can be added to the network. Before the first bitcoin halving, miners were rewarded 50 BTC for each new block they added to the network. In the 2020 halvening it's expected the bitcoin rewards to miners per block will reduce from 12.5 to 6.25 BTC.

Monitoring bitcoin halving events is essential not just for traders and miners but holders as well. Although the next event is not the first, the circumstances surrounding each halving are different and demand for bitcoin can fluctuate wildly based on the potential limitations of the supply of new coins. The number of bitcoin found per block could become more scarce which can cause prices to increase if demand remains high. The reward halving is one of the bitcoin sub-protocols that ensures that bitcoin total supply will reach 21 million.

What is the importance of Bitcoin Halving?

Within the current inflationary models of our financial systems, quantitive easing or the introduction of new money into the money supply by a central bank has become a common and predictable phenomenon. Opposite to this is Bitcoin's deflationary economic model, where the issuance of new currency lessens over time, which means that it will be worth more later on. This can be attributed to the scarcity associated with the finite number of bitcoin's that can be mined in all of its existence.

“If the coinage does not increase as fast as demand, the opposite of inflation will occur, and early holders of the currency will see its value increase. In an economy, money has to be distributed and produced somehow, and a constant rate seems to be the best formula.” - Satoshi Nakamoto

So, taking into consideration the scarcity, mining difficulty and the controlled supply of Bitcoin, what you get is a foolproof model of a commodity whose value increases over time. And even though we cannot predict how the halving will affect Bitcoin’s price in the long run, we can positively predict that the trend will continue throughout 2020 and after the halving.

It’s important to note that with each halving, there were different variables at work. With the first, it was the first time a halving ever happened, and no one had any real idea what to expect. The second time, the rise of Ethereum and initial coin offerings was a new factor that was not happening in 2012. Hopefully, the Bitcoin halving of 2020 will act as another milestone in the maturity of the cryptocurrency market despite the mixed performance we've seen over the course of the last two years.

What happened the last time bitcoin halved?

Various crypto analysts have attributed the two astronomical bitcoin bull runs of 2013 & 2017 to the first two halvening events of 2013, 2016 and its not hard to understand why. The most recent rewards halving happened on 9 July 2016 which saw block rewards fall from 25 to 12.5 BTC. As a result of this event, prices rose from $576 to $650. This surge did not slow despite market volatility and BTC prices rose to new all time highs of more than $13,000 towards the end of 2017.

During the first halving of 28 November 2012, bitcoin experienced it first bull run similar to its 2016-2017 price performance. When the block reward dropped from 50 to 25 bitcoin investors were unsure how this would impact not just the adoption of the currency but its price as well. Positive market sentiment saw the prices skyrocket from $12 to a new high of $1,120.

Similar in both cases is the market correction that occured after each bull run. In 2014, prices retraced by almost 70% dropping from the $1,120 to the $300 range. By the end of 2017, btc was trading at almost $20,000 a new trading record whose gains we're quickly wiped and saw the currency trading at a modest $3,600 range by the end of 2018. If we should be expecting a similar trading pattern in 2020 is yet to be determined.

What To Expect With The Next Bitcoin Halving

As indicated earlier, the bitcoin halving is scheduled every #210,000 blocks mined until 21m bitcoins have been successfully mined. As such, we are expecting the next halving, that will see block rewards dropping from 12.5 to 6.25 bitcoins, to occur when block #630,000 is mined, predicated for the week between 18 - 24 May 2020. The exact date of this event can not be determined considering all the factors that influence the time it takes to generate new blocks varies. Currently the network averages one block every ten minutes.

Although the price and number of transactions on the network have slowly been climbing since the beginning of this year, for miners the halving might seem counterproductive considering the high cost of acquiring the computational resources required to becoming a bitcoin miner. After the prices plunge of 2018, the market saw several cloud mining services crash due to the high cost of maintaining their businesses. Some crypto analysts are expecting a similar crash after the halving of 2020.

Conclusion

As the supply of bitcoins inches towards its ultimate limit of 21 million, expect the basic economic principle of demand and supply to push its prices even higher than the all times high set in its 2017 bull run. Due to the increasing awareness of bitcoin and its adoption by key players in the financial markets anticipate its value to shine through not just in prices but also as viable trading currency.

Bitcoin is a cryptocurrency that was designed to be valuable. By setting specific rules and sub-protocols like the halving event, Satoshi Nakamoto ensured it remained deflationary thus keeping inflation in check and increasing its scarcity over time. I hope this gives you a better idea of what bitcoin halving is, and why it’s an important feature on the network.

Disclaimer: This is not financial advise, choosing to invest in Bitcoin should be a decision you reach after extensive research with a personal understanding of all the risks involved. As we say in this space DYOR (Do Your Own Reseach). Happy Investing